Protection PINTAR Assurance

Solution for protection of your children’s education funds

Protection PINTAR (dana PendidIkaN diserTAi pRoteksi) Assurance

Surely you have a financial plan, one of them is future child’s education fund. However, is there any guarantee that You will avoid the consequences of risks such as:

- Future child's education fund is not reached if the breadwinner dies.

- Lack of future child's education funds due to inflation in education costs.

Prepare child's education fund protection through traditional life insurance product with Protection PINTAR (dana PendidIkaN diserTAi pRoteksi) Assurance.

Product excellence

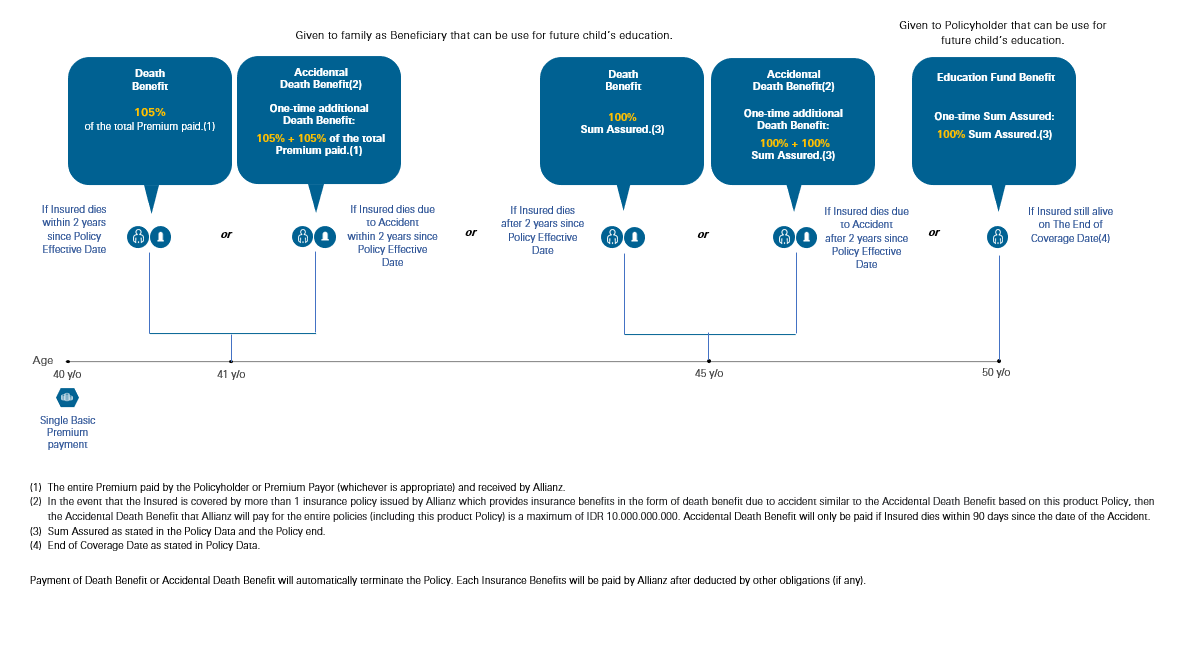

Death Benefit is 105% of the total Premium paid(1) if Insured the dies within 2 Policy Years(2) or amounted Sum Assured(3) if the Insured dies after 2 Policy Years(2).

Education Fund Benefit (as maturity benefit) amounted one time Sum Assured(6) if the Insured still alive on the End of Coverage Date(7).

Short Insurance Period for 10 years with choices of IDR & USD currencies as needed.

Policy submission without medical examination up to maximum Sum Assured IDR 10.000.000.000 / USD 770.000.(8)

Payment of Death Benefit or Accidental Death Benefit will automatically terminate the Policy. Each Insurance Benefits will be paid by Allianz after deducted by other obligations (if any).

Within 2 years since Policy Effective Date

- Death Benefit

105% of the total Premium paid.(1) - Accidental Death Benefit(2)

One-time additional Death Benefit: 105% + 105% of the total Premium paid.(1)

After 2 years since Policy Effective Date

- Death Benefit

100% Sum Assured.(3) - Accidental Death Benefit(2)

One-time additional Death Benefit: 100% + 100% Sum Assured.(3)

Payment of Death Benefit or Accidental Death Benefit will automatically terminate the Policy. Each Insurance Benefits will be paid by Allianz after deducted by other obligations (if any).

if the Insured still alive on the End of Coverage Date(1)

- Education Fund Benefit (as maturity benefit) One-time Sum Assured: 100% Sum Assured.(2)

Each Insurance Benefits will be paid by Allianz after deducted by other obligations (if any).

- Entry age:

- Insured: 1 month - 65 years old (nearest birthday).

- Policyholder: 18 years old - no maximum age (nearest birthday).

- Insurance Period: 10 years.

- Single Basic Premium option is available.

- Minimum Premium:

Single Basic Premium option: IDR 100.000.000 / USD 10.000

Increase and reduce the Premium is not allowed after Policy submission approved. - Currency: IDR & USD.

- Sum Assured term:

Allianz has the right to change the value of the Sum Insured multiplier due to adjustments to market conditions. This term only applies to new Policy submissions and has no effect on Policies that have been effective before. - Underwriting:

- Adult age ( Usia ≥ 18 years old) & income earner:

- Simplified Issuance Offer (SIO) for Sum Assured up to IDR 10.000.000.000 / USD 770.000

- Full Underwriting for Sum Assured > IDR 10.000.000.000 / USD 770.000

- Child age (Usia ≤ 17 years old) & non income earner:

- Simplified Issuance Offer (SIO) for Sum Assured up to IDR 5.000.000.000 / USD 380.000

- Full Underwriting for Sum Assured > IDR 5.000.000.000 / USD 380.000 up to Rp8.000.000.000 / USD 616.000

- Adult age ( Usia ≥ 18 years old) & income earner:

- There are exceptions for Insurance Benefit according to effective terms and conditions in the Policy.

- Protection PINTAR Assurance Brochure

- Ringkasan Informasi Produk dan Layanan (RIPLAY) Umum

- Customer Center Allianz Care:

Call center: 021-1500136

Email: ContactUs@allianz.co.id

Website: www.allianz.co.id - Note:

Protection PINTAR Assurance is an insurance product issued by PT Asuransi Allianz Life Indonesia and not PT Bank HSBC Indonesia's product. Thus, it is not guaranteed by Bank, and is not included in the government's loan guarantee program or deposit guarantee program.

Any information listed in this website is not a part of insurance product policy ("Insurance Policy") and therefore does not constitute agreement for any insurance products between PT Asuransi Allianz Life Indonesia and customers. Customers are bound with terms and conditions listed in Insurance Policy

PT Bank HSBC Indonesia hanya bertindak sebagai pemberi referensi Protection PINTAR ( dana PendidIkaN diserTAi pRoteksi ) Assurance.