Protect Invest Plus

Start Growing and Protecting Yours Tomorrows, Today

Protect Invest Plus by Allianz

Protect Invest Plus is a unit link life insurance product that provides protection solution along with long term potential investment accumulation so that your future financial plans are protected from various life risks.

Product Highlight

Easy to choose protection benefit options according to needs(1).

105%(2) Regular Basic Premium allocation as Investment Fund(3) since 6th Policy Year onwards for potential Investment Value.

Flexible in Total Regular Premium frequency and amount according to financial plan.

Using single bid and offer Unit price.

70% Persistency Bonus Benefit from Regular Basic Premium at the end of 5th Policy Year(4).

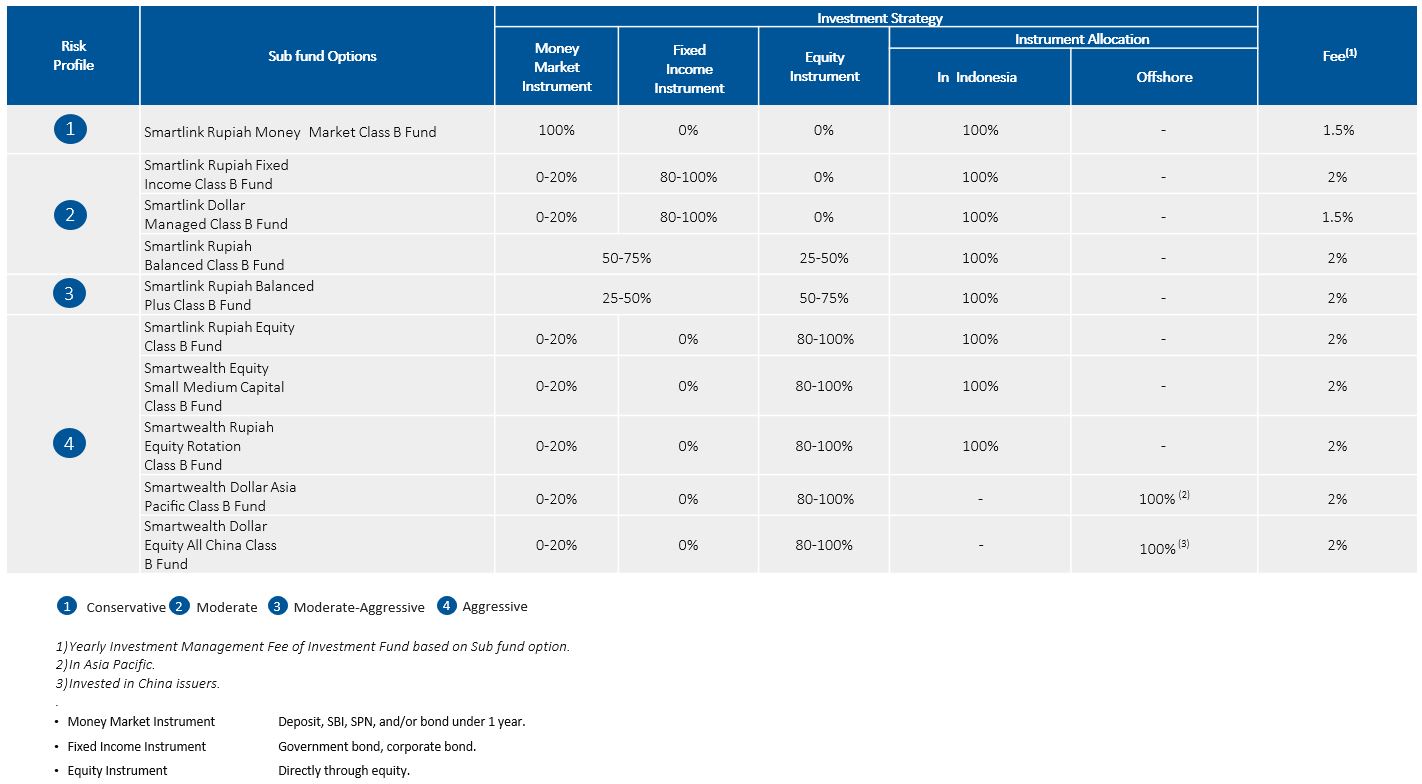

Investment opportunity in Indonesia & Asia Pacific.

Product Benefit

100% life Sum Assured + potential Investment Value (not guaranteed) if Insured dies*.

*Life Insurance Period until Insured age 100 years old.

- 49 critical illness types Sum Assured, with options:

- Critical Illness Plus

100% Sum Assured and not decrease basic life Sum Assured. - Critical Illness Accelerated

100% Sum Assured and decrease basic life Sum Assured.

- Critical Illness Plus

- Critical Ilness 100

100 critical illness conditions Sum Assured covering:- 50% SA Early Stage.*

- 100% SA Intermediate Stage.*

- 100% SA Advanced Stage.*

- 120% SA Catastrophic Stage.*

- +10% SA Angioplasty.*

- +20% SA Diabetic Complications*

- Flexicare Family

Daily inpatient & surgical cash plan in hospital including family members as Insured in 1 Policy. - Prime Medical Protection

As charge hospital benefit indemnity up to worldwide hospital coverage.

Additional Notes:

- Additional Insurance Benefit only available for new Policy submission.

- Critical Illness 100 only available for basic Policy with IDR currency option.

- Prime Medical Protection cannot be added together with Hospital & Surgical+ in other product (if any).

Investment Benefit

Regular Basic Premium(1) as Investment Fund(2) |

|

|---|---|

IDR

|

US Dollar

|

- Maturity Benefit: Formed Potential Investment Value(3).

- Potential Investment Value(3) can be withdrawn as needed.

Persistency Bonus Benefit

70% from Basic Regular Premium paid or annualized Regular Basic Premium on the 1st Policy Year (excluding Regular Top Up Premium and/or Single Top Up Premium (if any)).

Persistency Bonus Benefit will be paid at the end of 5th Policy Year in the form of additional investment Unit according to Policy terms and conditions.

Other Information

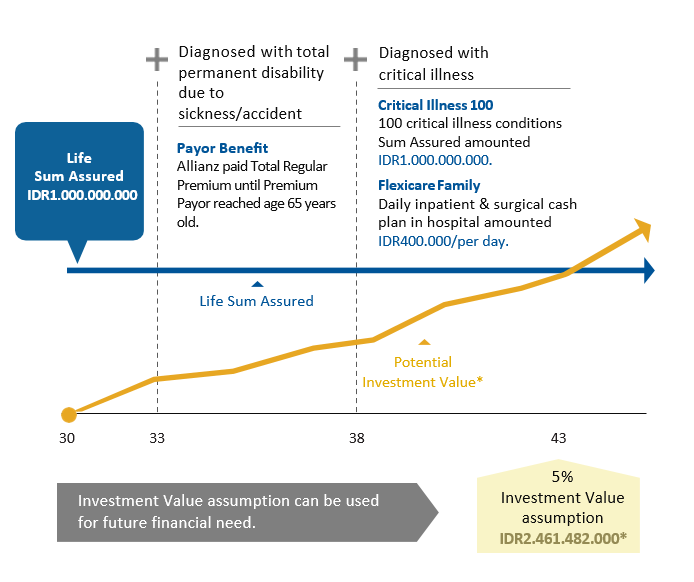

| Jonas 30 years old, non-smoker Company Manager Risk Profile: 4. Aggresive |

Need: Maximum protection for future financial plan. Regular Total Premium: IDR150,000,000 per year for 20 years (Regular Basic Premium: IDR40,000,000 + Regular Top Up Premium: IDR110,000,000) |

*) Investment Value assumption formed in benefit illustration above is not guaranteed and may change from time to time depends on Smartlink Rupiah Equity Class B Fund investment performance.

- Insured entry age: 1 month - 70 years old (nearest birthday).

- Life Insurance Period: Until age 100 years old.

- In IDR & US Dollar currency.

- Full Underwriting conditions apply based on Policy conditions.

- There are Insurance Benefit exceptions based on Policy terms & conditions.